Porter's Five Forces

Michael E. Porter's Five Forces model helps business strategists understand and evaluate the external factors affecting the competitive position of an organisation.

What it is

Porter's Five Forces is a strategic model designed to help business leaders identify, analyse, and evaluate the external factors affecting a company's competitive position. The analysis provided by the model provides a valuable insight into the attractiveness of a market, allowing businesses to make strategic decisions regarding the positioning of a product or service.

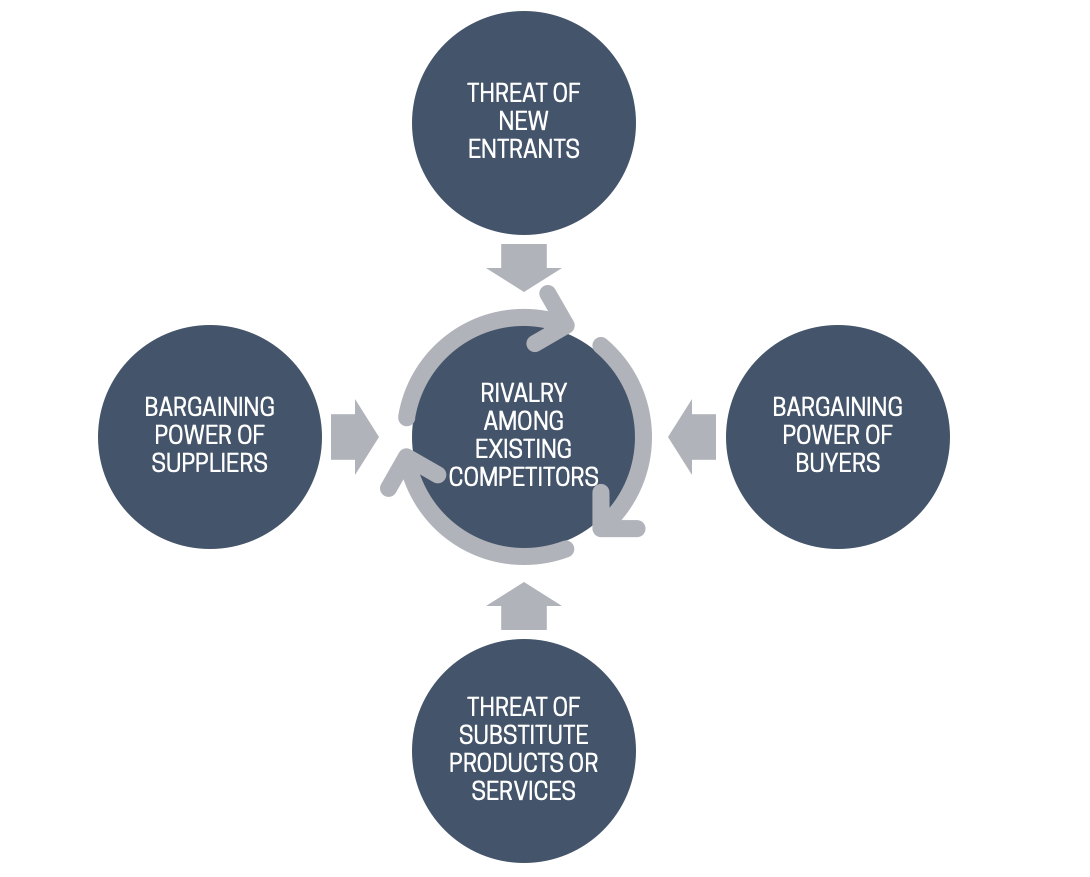

The five forces that shape industry competition that Porter considers in his model are:

- Threat of new entrants - what are the barriers to entry for new competitors?

- Threat of substitute products or services - how easily can an alternative replace the product or service?

- Bargaining power of buyers - how effectively can buyers drive a bargain?

- Bargaining power of suppliers - how influential are suppliers in deciding price and availability?

- Rivalry among existing competitors - what advantages do competitors have?

These five forces can all act against a company unless plans are made to defend against them or influence them in the company's favour.

"Understanding the competitive forces, and their underlying causes, reveals the roots of an industry's current profitability while providing a framework for anticipating and influencing competition (and profitability) over time." - Michael Porter (2008)

Background

In 1979, a young Michael Porter published his first of many articles in the Harvard Business Review, "How Competitive Forces Shape Strategy" (see Further reading). At the time, Porter was working as an associate professor at Harvard Business School, investigating the economic theories of industrial organisation and their role in preventing large companies from gaining monopoly power. This work led him to further research why some companies were so consistently profitable and dominant within markets and their commonalities.

The Five Forces framework was the result of this research and was revolutionary within the field of competitive strategy. It remains to this day one of the most widely taught and used market analysis models.

"Using the five forces framework, creative strategists may be able to spot an industry with a good future before this good future is reflected in the prices of acquisition candidates." - Michael Porter (2008)

When to use it

- To develop strategies to counter potential competitive forces with an industry

- To identify the forces that could be influenced to gain a more significant market share

- To identify opportunities for increasing profitability

- To carry out competitor analysis

- To analyse changes within the market dynamics of an industry

How to use it

The Five Forces model can be used to both describe the current situation in a market and as a way to look for ways to improve a company's position. In either case, each of the five elements within the framework, and their effects on the business, should be analysed thoroughly.

The size of each of the forces may differ wildly by industry. For example, the threat of new entrants is relatively low for the aircraft manufacturing sector due to the enormous investments required to enter that market. However, their customers place orders for considerable sums of money, often for more than one aircraft, giving them vast bargaining power.

The following sections describe some of the considerations for each item:

Threat of new entrants

New entrants to a market threaten to reduce the market share of any other firm operating within the industry. Their desire to gain a foothold in the market may bring reduced prices and investment, which will need to be withstood and countered.

The cost of defending against new competitors can be high, so markets with a high barrier to entry, acting as a deterrent to new entrants, are considered more attractive than those in which newcomers can enter and compete with a modest investment and little retaliation. Barriers to entry may include:

- Supply-side economies of scale - lower costs per unit available only through high-volume production forces competitors to enter on a large scale.

- Demand-side benefits of scale - a large and loyal customer network will mean that new entrants will need to work harder to win market share.

- Customer switching costs - these are the costs to a customer for switching suppliers. These may include technology and integration costs or the cost of re-training employees, for example.

- Capital requirements - this is simply the capital investment required to enter a new market.

- Incumbency advantages independent of size - these are the advantages the current market leaders enjoy due to their existing position in the industry. This may include proprietary technology, geographical location or an established brand reputation, for instance.

- Unequal access to distribution channels - for markets reliant on third-party distribution channels such as supermarkets, travel agents or wholesalers, obtaining a favourable distribution deal (prime space on a supermarket shelf, for example) can be a significant challenge.

- Restrictive government policy - in certain industries, government regulations work effectively as barriers to entry through means such as the requirement to obtain difficult and expensive certifications, expansive environmental or safety regulations, or by directly limiting the overall size of a market.

Threat of substitute products or services

A substitute product or service is one that provides a similar function but through a different means. Common examples include:

- Video-conferencing is a substitute for air travel

- Accounting software is a substitute for accountancy services

- Plastic is a substitute for aluminium

- A smartphone is a substitute for a camera

Other substitutes are less obvious. Second-hand products are substitutes for new ones, Do-It-Yourself (DIY) is a substitute for a professional service, and not buying a product at all is a substitute for a purchase.

Bargaining power of suppliers

Most companies rely on a wide range of suppliers to operate their business. Powerful suppliers are able to charge higher prices for their products and can limit quality or quantity to firms reliant on their supply. A supplier can be described as powerful if:

- It is more concentrated than the industry it supplies. For example, there are vastly more electronics and computer manufacturers than suppliers of the microprocessors that power them.

- The supplier serves many industries, and it is therefore not reliant on supply to a single market.

- The supplier's customers face switching costs if they are to move to a new provider.

- The supplier offers unique products, such as patented technology.

- There is no substitute product or service available.

- The supply can credibly threaten to enter the market themselves.

For many service companies, the primary source of supply is employees, who can hold considerable bargaining power.

Bargaining power of buyers

This is the power of the customers to make demands on a market such as low prices, superior service or high quality thresholds. In some industries, customers will leverage competition within the space to play industry participants off against one another. A buyer group is powerful if:

- There are few buyers, or each buyer buys in large volumes relative to the size of a single merchant.

- The products within an industry are too similar or standardised, thereby giving customers the power to purchase an equivalent product elsewhere.

- The switching cost for buyers is low.

- The buyer can credibly threaten to start producing the product or service themselves.

Price is often a factor for buyers. A buyer is price sensitive if:

- The product they are buying represents a significant portion of its cost structure or total procurement budget.

- The buyer earns low profits or has budgetary constraints.

- The quality of the buyers' end product or service is little affected by the quality of the item they are purchasing.

- The item they are purchasing has little effect on buyers' other costs.

Rivalry among existing competitors

Inter-company rivalry within an industry can take many forms, such as price discounts, the introduction of new products, upgrades to existing products, marketing campaigns and service enhancements.

Rivalry among existing competitors is most intensive if:

- There are a large number of competitors of equal size and power.

- Exit barriers are high, perhaps due to the loss of initial investments, for example.

- Rivals have aspirations to hold a dominant or monopoly position within the industry.

Intense rivalry can limit the profitability of an entire industry as it can drive down prices and raise costs throughout. It is not uncommon to see competitors attempt to gain customers by lowering prices and increasing marketing budgets, forcing others in the industry to follow suit in a downward profit spiral. Price competition is likely to occur if:

- Products and services of suppliers are effectively equivalent, and there is little switching cost for buyers.

- Fixed costs are high and marginal costs are low, causing the temptation to set prices close to the marginal costs to gain market share while still making some contribution towards covering fixed costs.

- Capacity increases must be made in large increments, e.g. the purchase of new factories or expensive machinery.

- The product has a limited shelf life.

If the purpose of the exercise is to describe a market environment, perhaps when considering a new product launch, this exercise will give a clear picture of the current state of an industry.

Often the exercise is used during efforts to improve a company's position within a market. In that case, leaders should now look for ways to push back against some or all of the competitive forces identified, through influencing forces to their advantage or re-positioning within the market, for example.

Further reading

Porter, M. E. (1979) How Competitive Forces Shape Strategy. Harvard Business Review, 57(2) 137-145.

Porter, M. E. (1980) Competitive Strategy: Techniques for Analyzing Industries and Competitors. New York: Free Press.

Porter, M. E. (2008) The Five Competitive Forces That Shape Strategy. Harvard Business Review, 86(1) 78–93.

Some of the links to products provided in this article are affiliate links. This means that the supplier may pay the owner of this website a small amount of money for purchases made via the link. This will have absolutely no impact on the amount you pay.